January 11, 2024

2023 Investment Landscape in Carbon Removal

A post by Tank Chen, with input from Alex Rink & Robert Höglund

Preface

At CDR.fyi, our mission is to accelerate durable carbon dioxide removal (CDR) with permanence over 100 years. We looked at investment activity over the past year to understand how the market may evolve in the coming years. However, as the market for overall carbon removal is still dominated by less durable forms of CDR, we looked first at the overall CDR market and then drilled down to the durable CDR market in particular.

What you will see below is a summary of all investment activity that we tracked across carbon removal worldwide.

*Note that this analysis builds on public sources. There is a significant number of deals that are private and thus not included in the analysis. For more information about our methodology, scroll to the bottom of the post.

Key Takeaways

In 2023, there was $1.2B of early-stage investment in the carbon removal industry overall, of which roughly ⅔ was from carbon removal suppliers and solution developers, and ⅓ to companies commercializing support services.

There were 68 financing transactions across 66 companies, from 211 investors. Of the 211 investors, 17 invested in more than one company.

Financing activity was dominated by 3 countries, with 90% of total investment taking place in the US, UK, and Canada.

While durable CDR represents a fraction of overall carbon removal sales and deliveries, it accounted for over 60% of investment in carbon removal solution providers. DAC, Mineralization and Bio-oil claimed almost 70% of that total but financings were spread to other methods with the potential to play a role in driving large-scale durable carbon removal.

At only 3.9% of climate tech investment and 0.076% of clean energy investment in 2023, investment in carbon removal is a significant and under-served financing opportunity given its anticipated multi-gigaton contribution to net zero goals.

The Carbon Removal Investment Landscape

In 2023, we saw 66 companies receive USD$1.25 billion in earlier-stage capital investment from 211 investors in 68 deals across all forms of carbon removal.

Of the $1.2B, $838M went to carbon removal solution developers, and $412M to companies providing supporting services for the ecosystem, such as Management, Reporting and Verification services (MRV), credit certification, credit rating, marketplace, insurance, project development, and carbon management services.

63 of the 66 companies that raised financing are based in the US, Canada, or Europe. Contrary to reports of a slowdown in early-stage climate-tech investment, startups dominated the CDR investment landscape. In 2023, 211 investors participated in the carbon removal space, with governments disbursing over $24M in direct investment through grant programs. While familiar players like VCs and strategics play a vital role in supporting startups in the space, growth capital, private equity, asset management, banks, sovereign wealth funds, and philanthropic entities have also entered the arena.

While these new entrants can be seen as evidence of a solidifying foundation for the carbon removal industry, the $1.25B total investment in carbon removal is still modest compared to the total investment in clean energy. To put it in perspective, the IEA projected global clean energy investment in 2023 to be $1.64T, with $129B and $659B in EV and renewables alone. Thus, the total investment of $1.23B in carbon removal represents only 0.076% of the total clean energy investment. Looking more specifically at the climate tech startup space, carbon removal’s $1.25B represents 3.9% of the $32B in VC investments into climate tech in 2023 that CTVC tracked.

These numbers are a fraction of what is required to meet projected needs, both for CDR and climate investments overall. A 2023 report published by McKinsey outlining the importance of investment in supporting CDR innovation to drive down costs and accelerate project developments puts the estimated investment required by 2030 to meet 2050 targets at between $0.5 - $2T (including project finance and other sources of funds) and projects the expected investment to fall short at between $100 - $400B.

It is important to note that funding technology innovation alone won’t scale carbon removal. In addition to funding, companies will need to prove that there is a market to support sustainable growth. For early-stage companies, finding buyers and signing offtake agreements becomes crucial in attracting and securing growth capital and project financing for their first-of-a-kind projects and onwards to scale their technology. Government policy and industry initiatives will play a pivotal role in incentivizing purchases of carbon removal in both the compliance and voluntary markets.

Overall CDR Investment Activity

Investment by Category

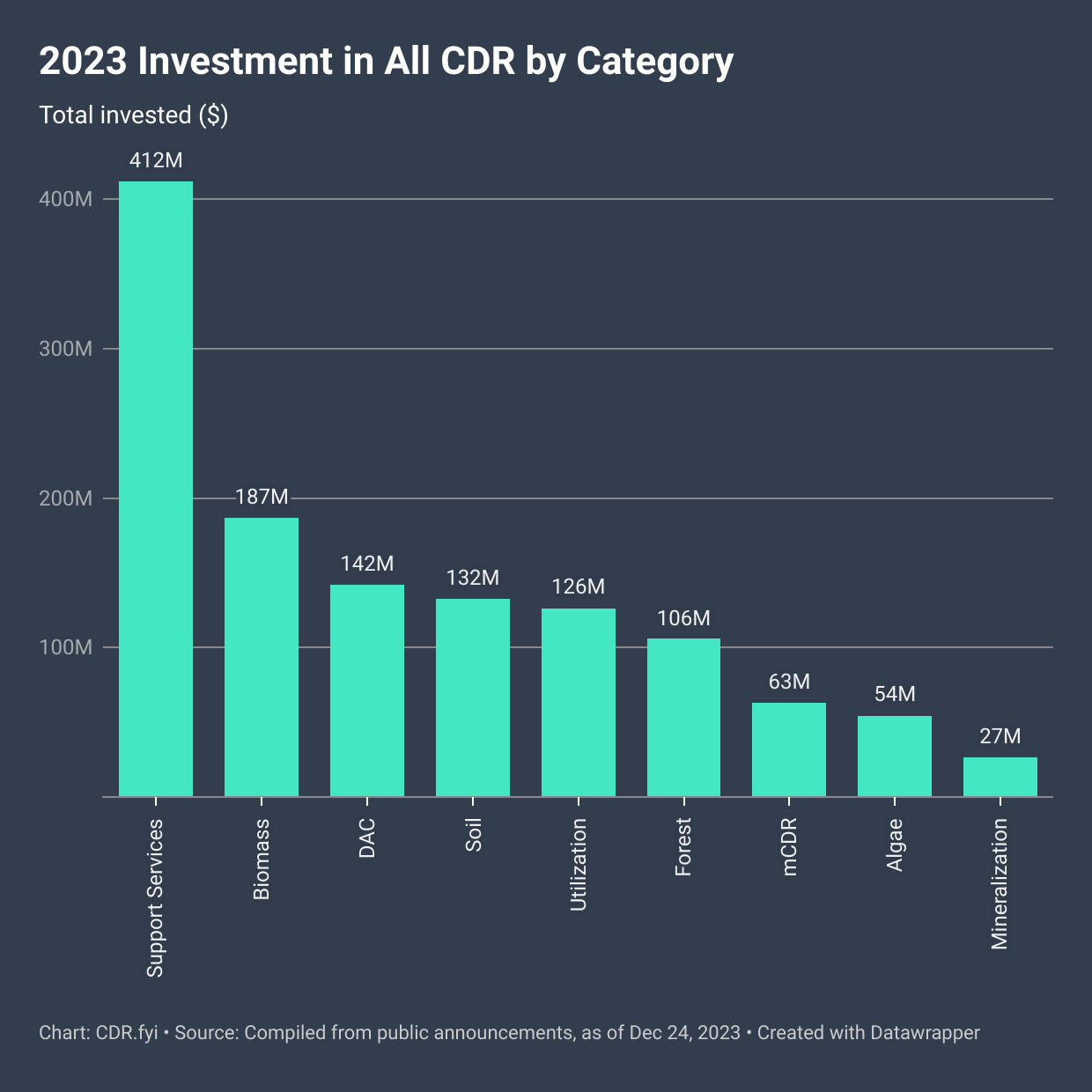

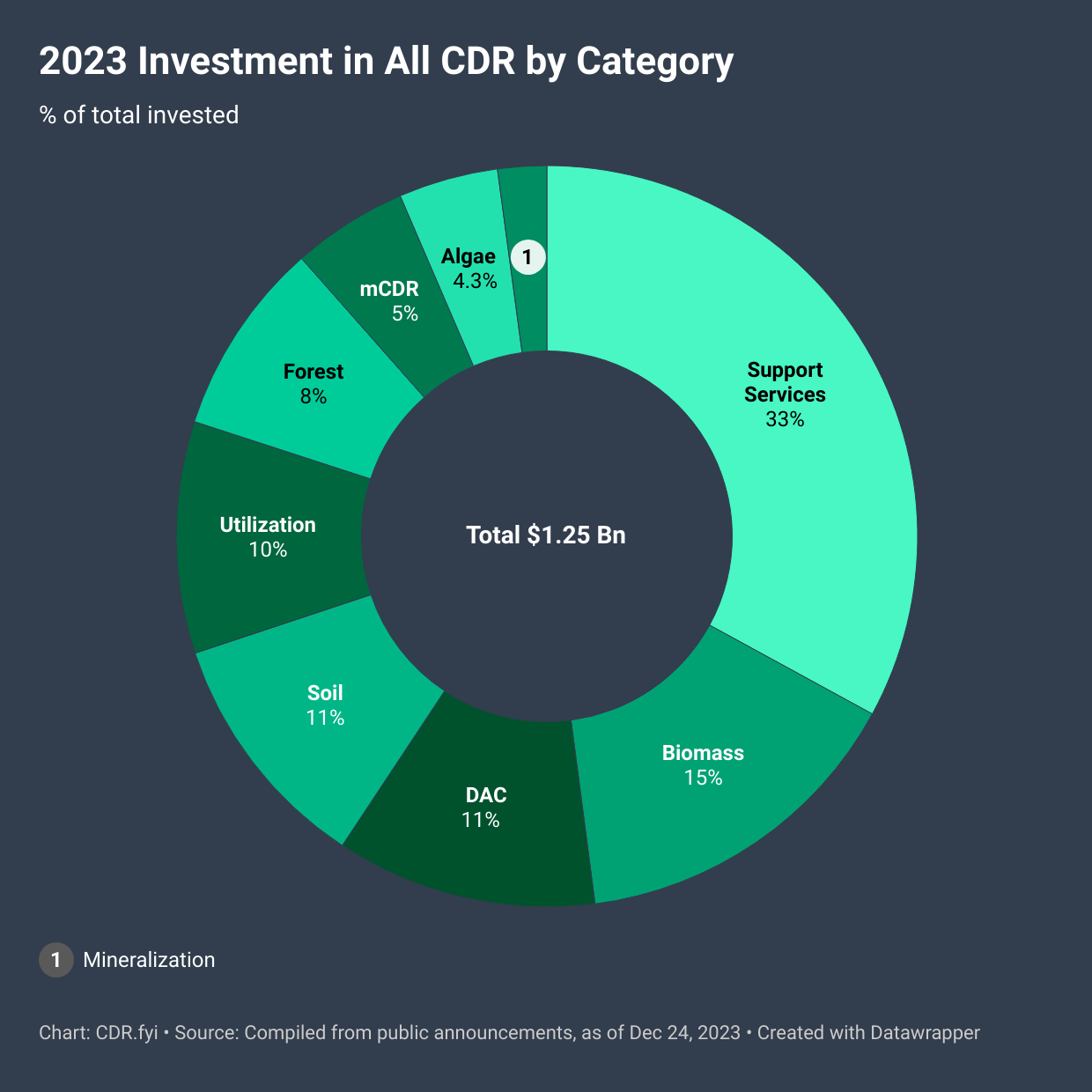

Support services providers, biomass-based removal companies, and direct air capture (DAC) companies dominated fundraising in 2023. The collective of 19 Support Services providers (excluding CDR suppliers) raised the highest amount at $412M (33% of total), with the majority of capital flowing into marketplaces, exchanges, and other carbon management service providers. Nine marketplace actors also raised a total of US$113M. Biomass-based removal companies, including 5 biochar, 2 BiCRS, and 1 bio-oil, collectively raised more than US$187M (15% of the total). DAC witnessed the third largest share of capital infusion with 11 companies, the majority of which are US-based, seeing a total investment of $142M (11%).

The remaining 41% of investment was distributed among other carbon removal technologies and related services:

- $132M (11%) to 5 soil-related startups

- $126M (10%) to 6 carbon-utilization startups

- $106M (8%) to 6 forestry-related startups

- $63M (5%) to 3 marine-CDR startups

- $54M (4.3%) to 2 algae-based removal startups

- $26M (2.7%) to 8 mineralization startups

While the significant investment in support services acknowledges the integral role played by supporting services in the growth of the CDR market, it is equally important to acknowledge the diverse funding landscape within the broader carbon removal ecosystem. The distribution of investment across various carbon removal technologies manifests the portfolio approach championed by most in the space.

Investment by Stage

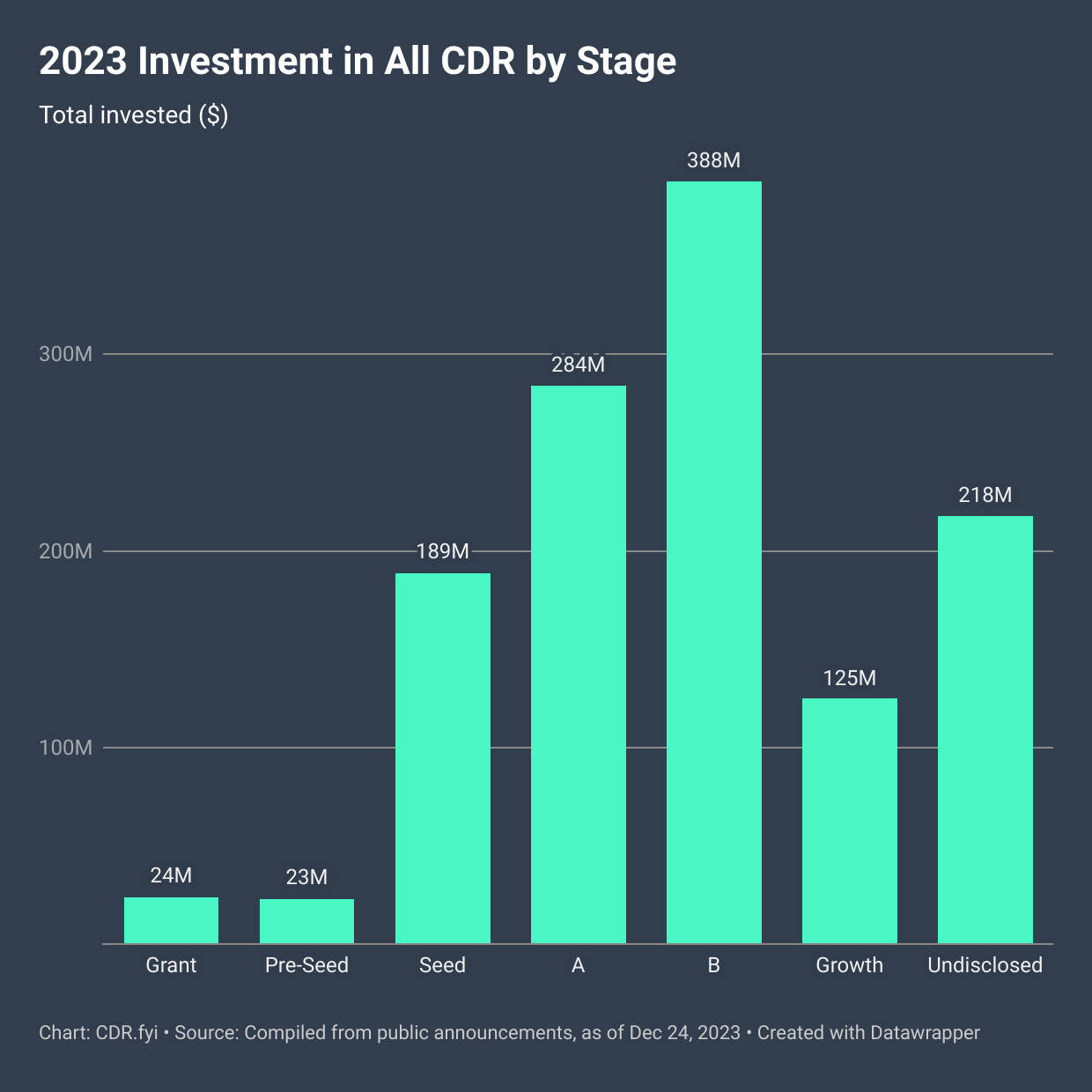

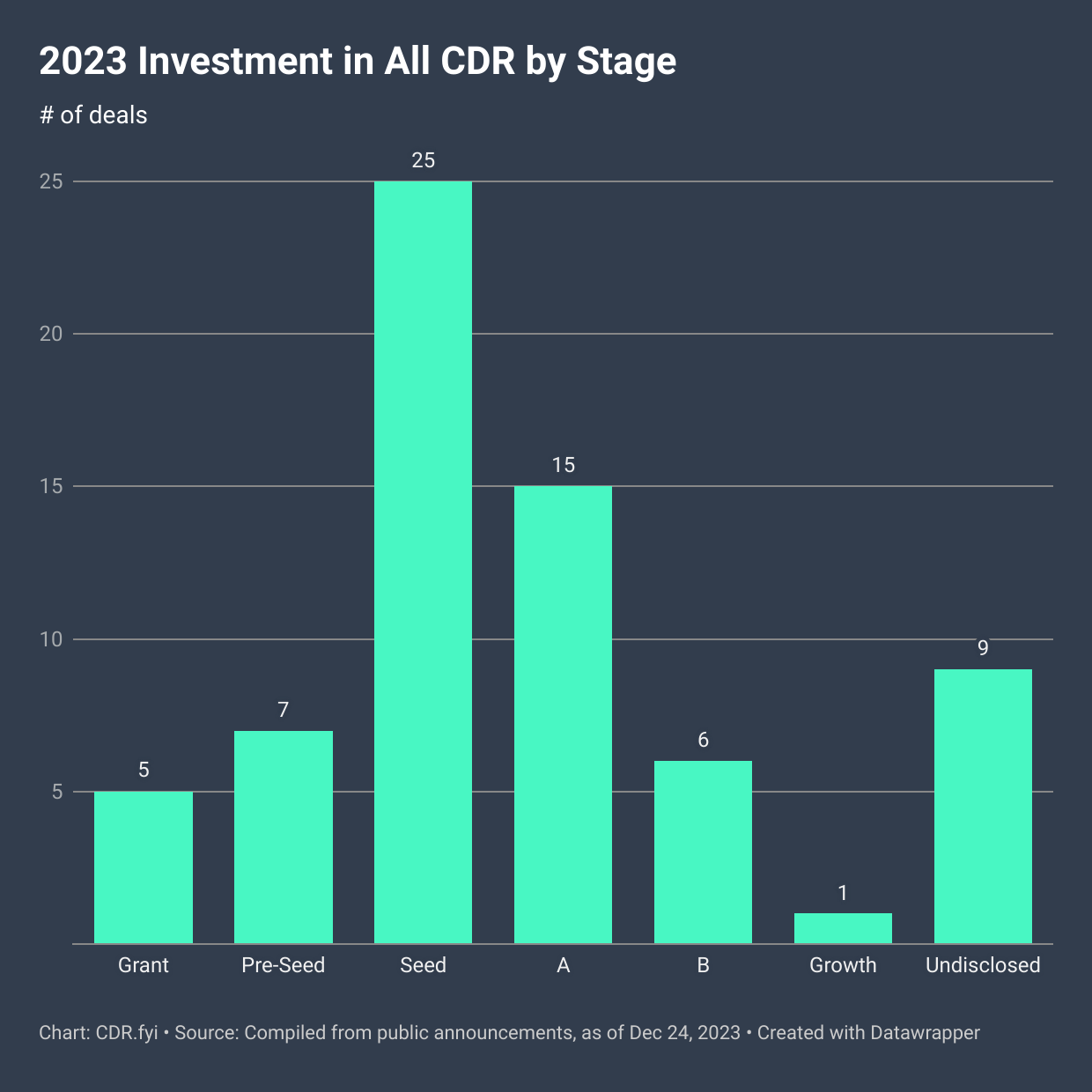

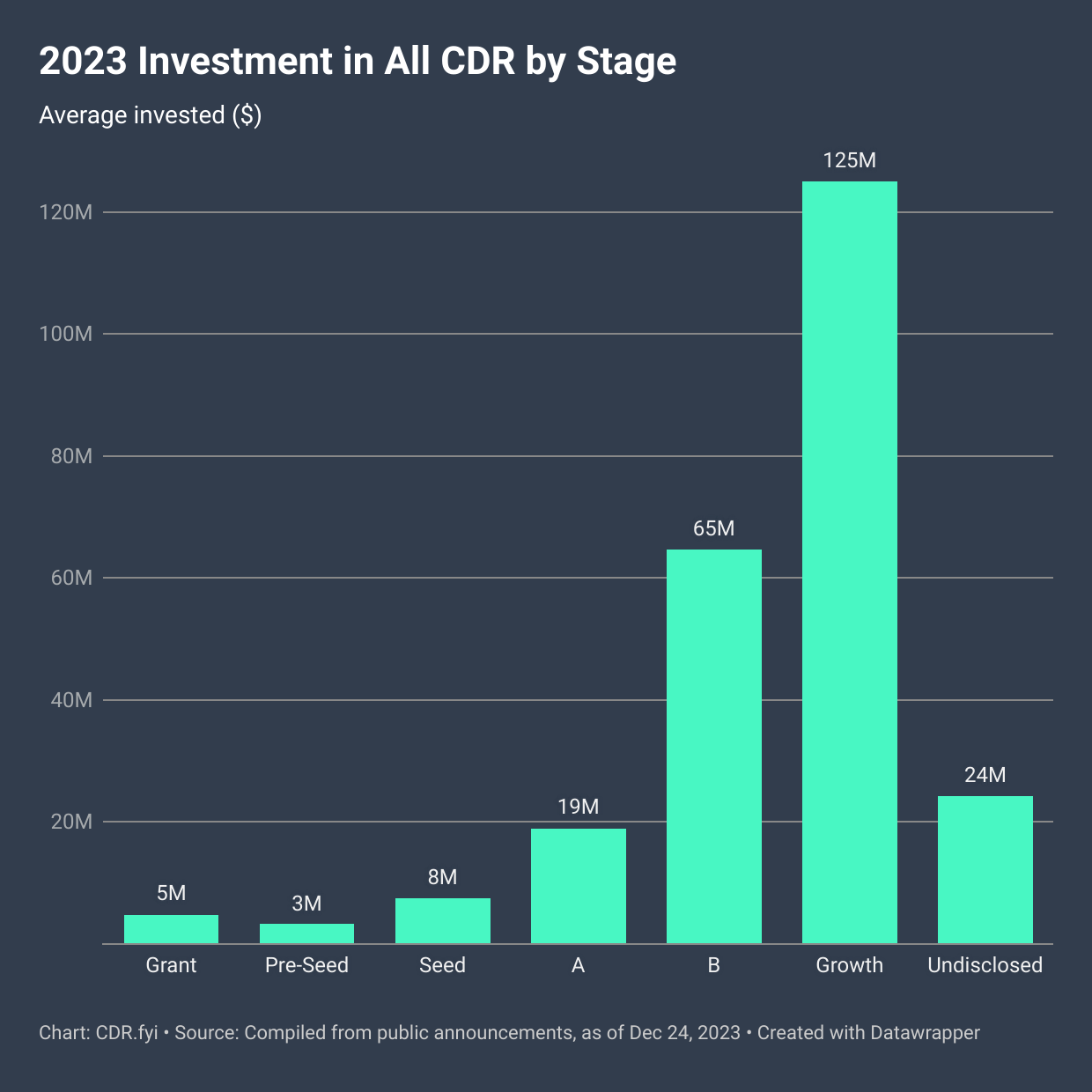

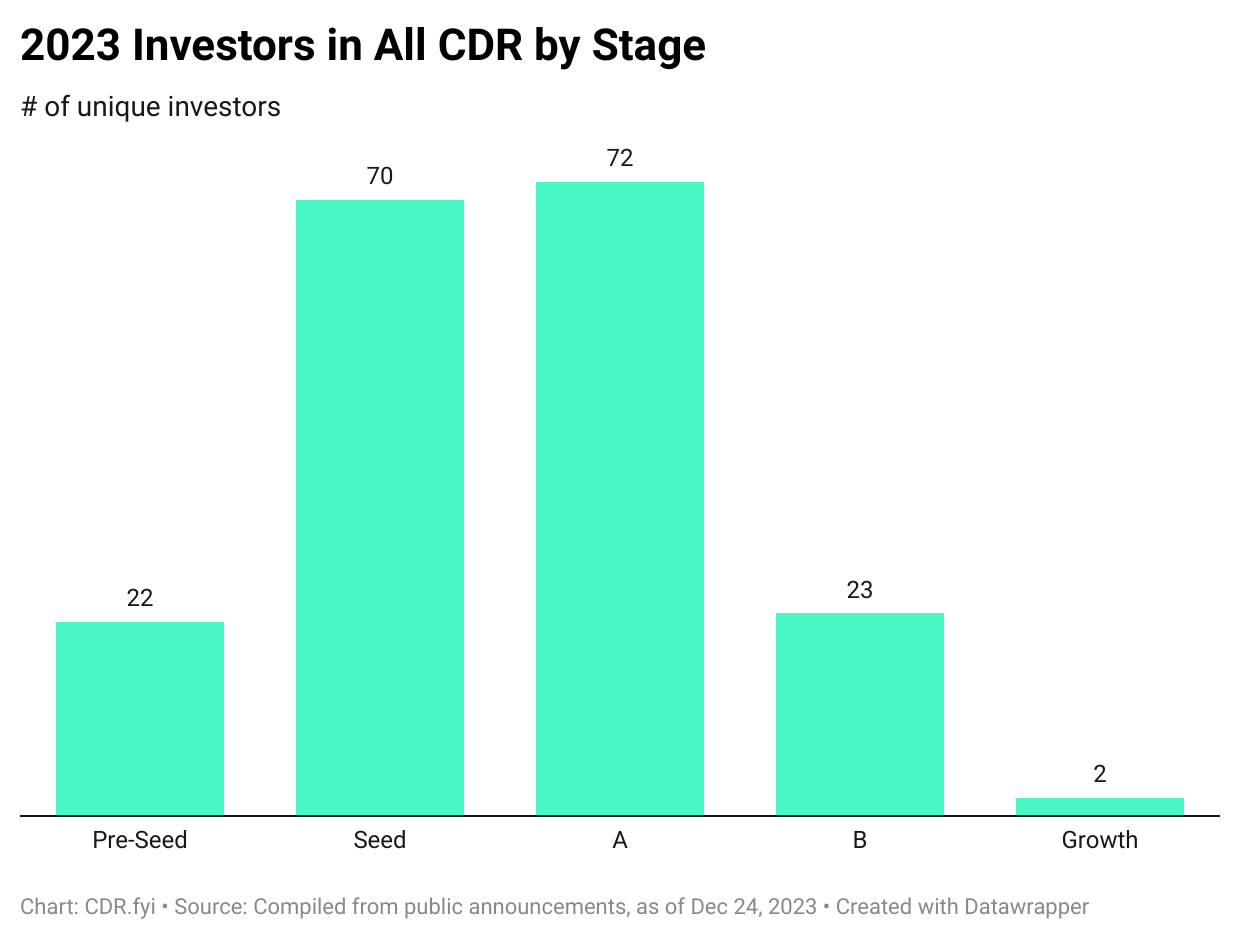

Startups raised on average $3M in 7 Pre-Seed rounds ($23M total), $8M in 25 Seed rounds ($189M total), $19M in 15 Series A ($284M total), and $64M in 6 Series B ($388M total). The escalating ladder of funding across rounds underscores investors' confidence across the various stages of development of this maturing market, while the relative dearth of growth-stage financing is an indication of its still nascent state.

Investment by Country

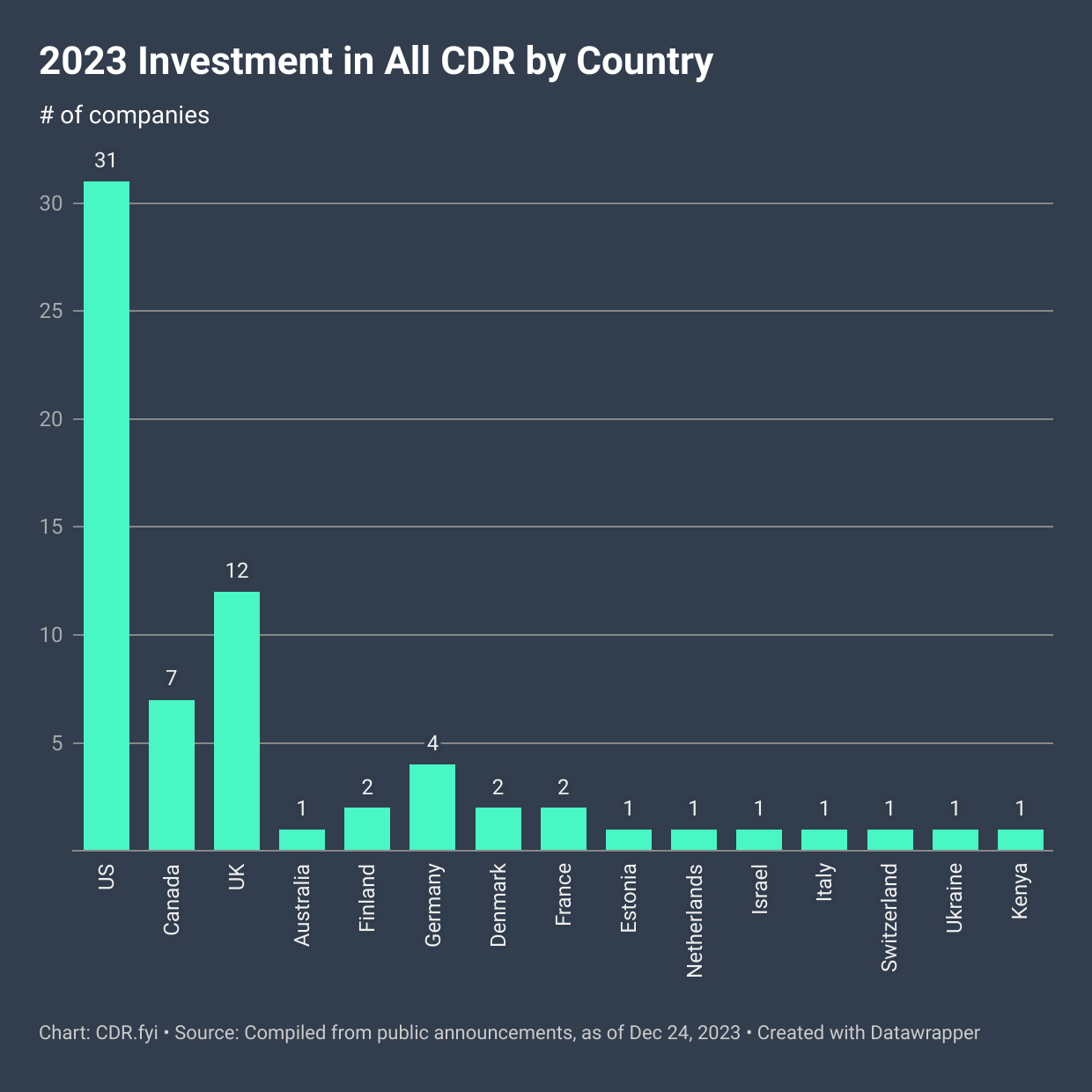

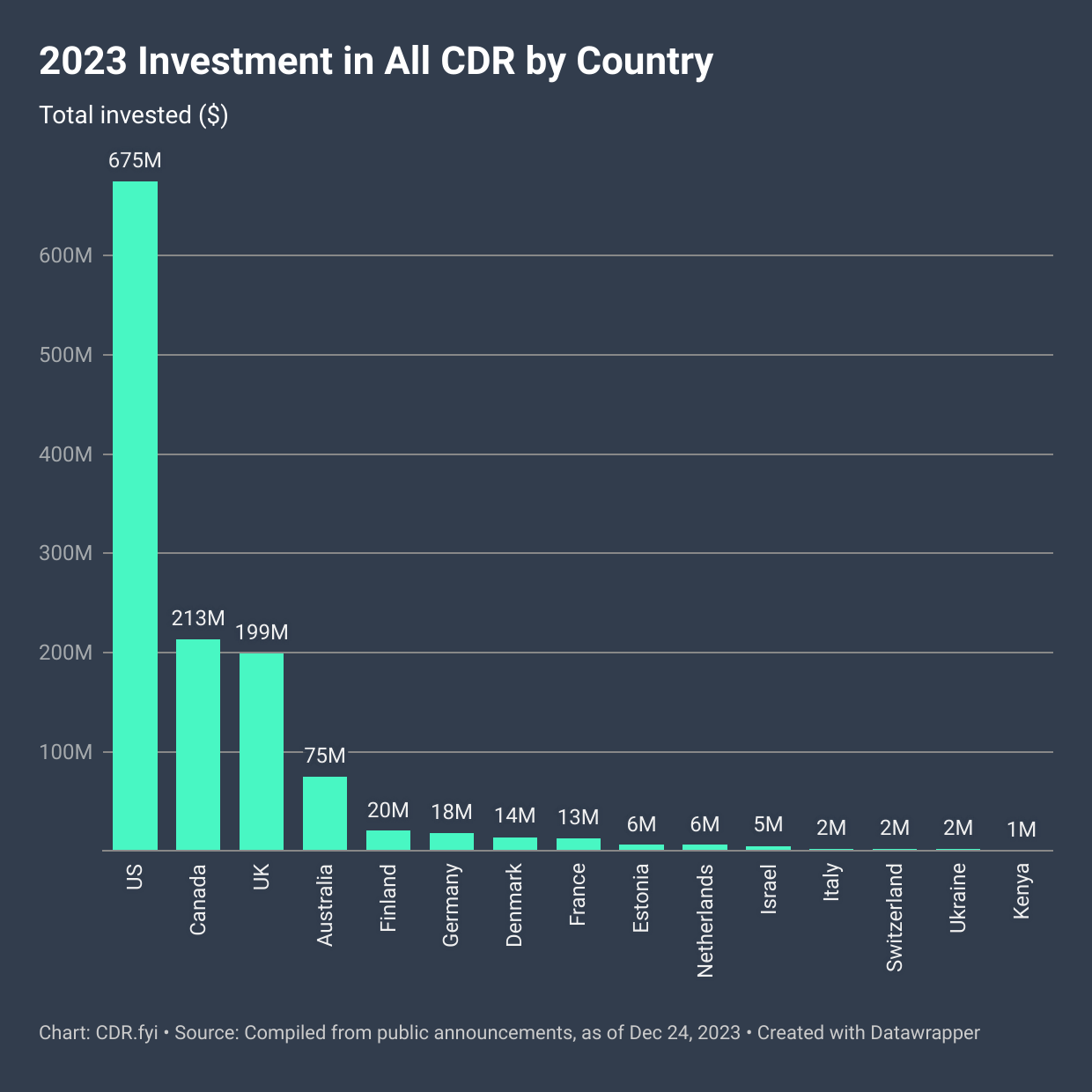

Geographically, the United States emerged as a pivotal hub for carbon removal innovation, with 31 US companies attracting $675M or 54% of the total. Six Canadian companies attracted $213M, while twelve companies from the UK raised $199M. Seventeen companies from all twelve other countries raised a total of $163M.

The high concentration of investments in a limited number of countries highlights the need for increased attention and investment in regions like Africa, Asia, South America, and the Middle East to foster a truly global and inclusive carbon removal development landscape.

CDR Investors

Overall, 211 unique investors across investor types (including government offices) contributed to the US$1.25B total investment in CDR. The most active investors were Lowercarbon Capital, Counteract, Carbon Removal Partners, Elemental Excelerator, Grantham Foundation, Übermorgen Ventures, Toyota Ventures, and the US DOE, followed by Breakthrough Energy Ventures, Brightspark Ventures, Climate Capital, Google Ventures, Investissement Québec, MCJ Collective, Microsoft Climate Innovation Fund, Plural, Shell Ventures, and Temasek. These investors all made multiple investments in 2023. (For a more comprehensive list of investors, see the resource section at the bottom of the post.)

The landscape is characterized by a mix of venture capitalists (VCs), corporate venture capitalists (CVCs) and strategics, growth capital providers, private equity firms, asset management entities, banks, sovereign wealth funds, and philanthropic capital. This increased diversity of investors as compared to traditional startup financing, and in particular the participation of the latter two groups, is indicative of the industry's potentially longer-term investment horizons, and the far-sighted view of the importance of seeding these companies prior to broader market recognition of their potential.

Spotlight on Durable CDR

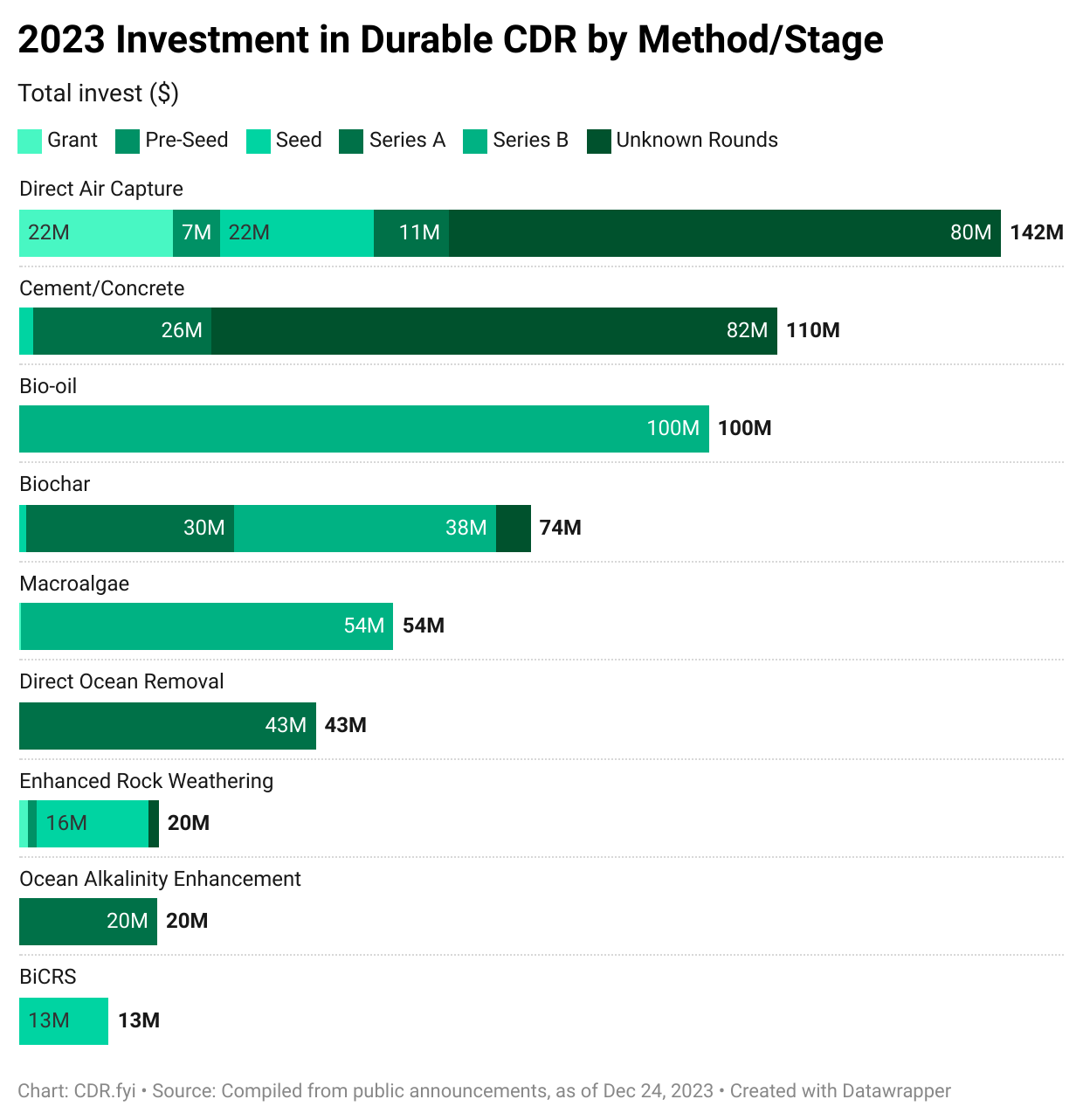

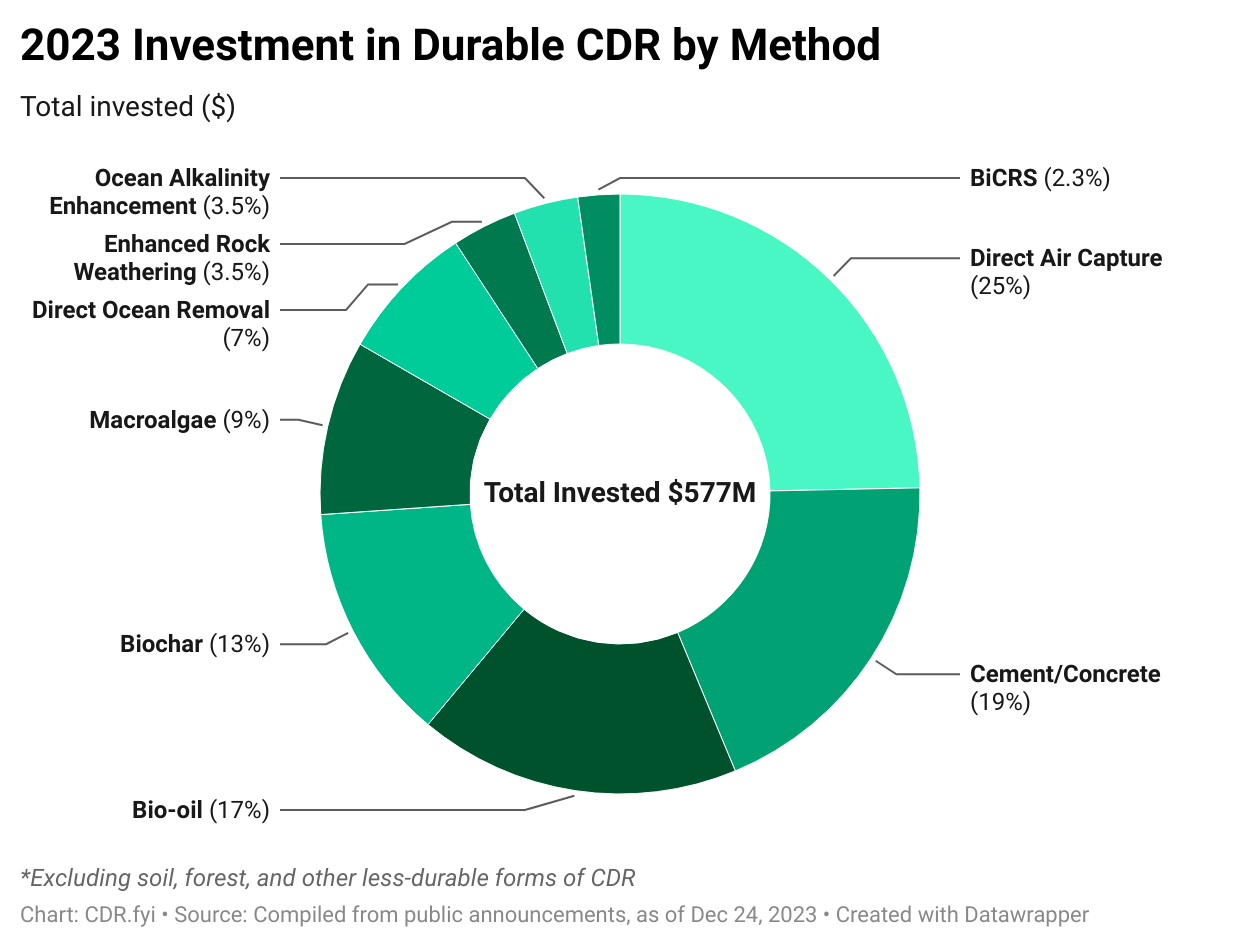

Omitting all support services, the total invested in durable CDR suppliers was US$577M. DAC companies led the way with 25%, followed by carbon in cement/concrete companies (19%), bio-oil (17%), biochar (13%), macroalgae (9%), direct ocean removal (7%), enhanced rock weathering (3.5%), ocean alkalinity enhancement (3.5%), and BiCRS (2.3%).

The distribution of investments across various carbon removal technologies and stages of development in 2023 demonstrates the variety of pathways to durable CDR. Very noteworthy is that while durable CDR represents a small fraction of the total CDR market, it significantly over-indexes on investment activity, representing 41% of total CDR investment (including support service providers) and 68% of CDR solution suppliers.

Methodology

To assemble this summary, we relied on publicly available sources such as deals presented in newsletters such as CTVC, Carbon Removal Updates, Carbon Business Council, and Carbon 180, press releases, social media posts, and searches. We excluded M&A activities such as Occidental Petroleum's $1.1B acquisition of Carbon Engineering and BlackRock’s $550M JV investment in 1PointFive, and converted all investment amounts to US$ using the exchange rates on Dec 24, 2023 with rounding to the nearest ten thousand dollars.

It is crucial to acknowledge that the data might not capture the entirety of fundraising deals in the carbon removal sector for the entire year of 2023. Variations in reporting practices and the dynamic nature of financial activities could contribute to potential gaps in the dataset. If you are aware of any financings that occurred in the sector that you believe we may have missed, we encourage you to reach out to us at team@cdr.fyi.