December 05, 2025

CDR Monthly Recap - November 2025

We are back with another edition of the CDR Monthly Recap, a monthly round-up of some of the top news, developments, and market updates from the world of durable carbon removal.

After a relative uptick in October, the durable CDR market in November saw over 268,000 tonnes of of CDR contracted, led by deals from Charm Industrial, Boeing, Reversion and Frontier Buyers.

New projects, partnerships, and large funding opportunities, as well as announcements, continue to drive momentum for the industry ahead, alongside various events in the field.

Read on to learn more below!

Help shape transparency in durable CDR capacity Participate in our joint survey with the State of Carbon Dioxide Removal to enhance transparency in tracking global carbon removal capacity. Learn more here.

Deals and Partnerships

[Image source: Charm Industrial]

Deals

Boeing signed an offtake agreement to purchase 100,000 tonnes of CDR from Charm Industrial, a US-based company that processes biomass to produce bio-oil and biochar and stores it underground to remove CO₂ from the atmosphere.

German BECCS company Reverion and Frontier signed an offtake agreement for 96,000 tonnes of CDR in a deal worth $41 million. As per the deal, the tonnes will be removed between 2027 and 2030.

Advance market commitment Frontier has entered into an agreement with Biomass Direct Storage company Graphyte, with $250,000 prepurchase of durable carbon removal credits from Graphyte’s Arkansas project.

Partnerships

Nasdaq and Carbon Direct opened pre-registration for the Carbon Issuance Calendar, a new platform to help buyers and suppliers coordinate durable CDR transactions with improved planning and liquidity.

The Open Standard Carbon Removal Purchase Agreement (OSCAR) was launched this week as a collaborative framework, providing standardized clarity and consistency in durable CDR contracting.

Verde Agritech entered an exclusive carbon-credit partnership with UNDO Carbon to commercialise Enhanced Weathering in Brazil, leveraging glauconitic siltstone to generate durable CDR credits.

The Saudi Water Authority (SWA) partnered with Ebb Carbon to launch the world’s first desalination decarbonization project, aiming to potentially scale to remove 85 megatonnes of CO₂ annually.

Voluntary Carbon Market Company (VCM) and CDR financier Altitude partnered to deliver large-scale, high-integrity carbon removals across the Global South, aiming to scale access to credits under leading verified methodologies.

The Carbon Business Council launched a Latin America working group to coordinate policy, market development, and community engagement for high-integrity carbon removal across the region’s emerging ecosystems.

Carbonfuture opened a government-backed tender for a BECCS project in Denmark, offering buyers durable, CRCF-eligible carbon removal credits through its digital trust Infrastructure.

Want to know more about durable CDR? Join over 1,000 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!

Projects

[Image source: NetZero]

NetZero opened a new biochar plant in Paraguaçu, Brazil, capable of processing 16,000 tonnes of biomass annually and removing over 6,000 tonnes of CO₂ while supporting over 250 local farmers.

Kawasaki Heavy Industries announced the completion of one of Japan’s largest direct air capture demonstration units at its Kobe plant. The facility is capable of capturing 100 to 200 tonnes of CO₂ a year using a proprietary sorbent.

Pure DC committed £24 million to support the development of the UK’s largest biochar facility in Wiltshire, UK. Operated by A Healthier Earth, the facility is expected to produce 11,500 tonnes/year and remove up to 18,500 tonnes/year.

CO280 successfully completed a carbon-capture field pilot at a U.S. pulp & paper mill, using modular capture units to trap biogenic CO₂, positioning for multiple projects to deliver removal by 2030.

Deep Sky launched operations of Airbus’s DAC technology at its Deep Sky Alpha facility. The unit is capable of removing 250 tonnes CO₂/year and its technology has been derived from Airbus’s life-support systems aboard the International Space Station.

UK-based project developer Onnu unveiled its proprietary CarboFlow pyrolysis system, deploying its first two units in Malaysia, which are expected to produce 1,924 tonnes of biochar annually.

CDR company Svante and forest owner association Södra announced that they will launch a carbon capture pilot at Sweden’s Värö site in 2026, testing solid sorbent filters to capture biogenic CO₂ and support climate goals.

Return Carbon announced a partnership with the Permian Energy Development Lab (PEDL) to establish the Trinity Campus, a DAC & storage facility in the U.S. Permian Basin in Texas, expected to capture up to 100,000-500,000 tonnes of CO₂ a year.

How did durable CDR fare in Q3 2025? Explore insights from the 2025 Q3 Durable CDR Market Update, in which we analyze and uncover major trends in the durable carbon removal market.

Financing

[Image source: Avnos]

Avnos secured up to $17 million to build Project Cedar, a first-of-its-kind hybrid DAC facility. It is expected to deploy four modules capable of capturing 3,000 tonnes of CO₂ per year and is scheduled to come online by the end of 2026.

US-based mineralization company Verde closed a $2 million strategic investment from commercial partner Ergon, following a 10-year license to commercialize Verde’s emulsion-based carbon sequestering BioAsphalt™ technology.

remove announced the selection of 16 startups that are part of the 8th cohort of its Europe accelerator program. The teams will undergo a 2-stage process covering areas such as CDR policies, markets, and MRV through expert sessions.

Calgary-based company Hempalta secured $2 million in funding to expand its industrial hemp and biochar carbon removal program, designed to generate approximately 100,000 verified carbon credits annually under standards such as ISO 14064-2 and Puro.earth.

Farm Credit Canada (FCC) made a strategic investment in UNDO through its venture capital arm FCC Capital to accelerate the deployment of UNDO’s enhanced weathering technology among Canadian farmers.

Pricing Mismatch in Durable CDR

Explore insights from the Durable CDR Pricing Survey, conducted in partnership with OPIS, to help market participants better understand pricing expectations for durable CDR credits.

Policy

[Image source: SBTi]

The Science Based Targets initiative (SBTi) launched the draft of its next Corporate Net-Zero Standard, proposing to include a framework for using CDR but no specific requirement for its support, limited to addressing long-term residual emissions.

The German parliament approved its 2026 federal budget, including a dedicated funding commitment of €476 million for CDR, with €98M to scale CDR projects, €11.5M for CDR credits, €2M for administration and €44.6M to strengthen soils as carbon sinks.

Research and Reports

[Image source: Carbonfuture]

Carbonfuture published a guide on what airlines must understand about carbon removal before 2026, emphasizing durable CDR’s role in meeting aviation climate targets and avoiding overreliance on short-lived offsetting solutions.

CSIRO, Australia’s national science agency, released Australia’s first Carbon Dioxide Removal Roadmap, outlining scalable technologies like DAC and Alkanlinity Enhancement to help achieve up to 330 Mt CO₂ removal annually by 2050.

Isometric issued its first verified CDR credits powered by automated data sharing via Certify‘s Open API. A total of 291 credits were issued to Charm Industrial, facilitated via Mangrove System’s dMRV platform.

A Healthier Earth released the Biochar Blueprint whitepaper, offering developers a practical guide to scale biochar carbon removal through bankable assets, investment readiness, and industrial performance.

Isometric obtained approval from the International Civil Aviation Organization (ICAO) to issue CORSIA-eligible carbon removal credits, enabling airlines to meet emissions obligations via CDR credits under the industry’s offset scheme.

Carbon to Sea Initiative, MEOPAR, and Planetary Technologies announced the launch of a new Joint Learning Opportunity in Halifax, Canada, that will commence in 2026, to advance ocean alkalinity enhancement research.

Puro.earth launched the 2025 edition of its Enhanced Weathering methodology update, introducing improved quantification, sampling guidelines, modelling clarity, and stronger uncertainty management for CDR projects.

Equinor and Captura validated Captura’s Direct Ocean Removal through a joint pilot system in Hawaii and are now designing a commercial facility capable of capturing 30–50K tonnes of CO₂ annually.

The TIDE Centre, University of Oxford, published a working paper, authored by Sebastian Manhart and Raphaël Cario, highlighting the Global South’s overlooked industrialisation opportunity in durable CDR.

Carbon Gap, in collaboration with Sweco, published a roadmap and a report highlighting Finland’s carbon removal potential, underscoring that scalable deployment is essential to achieve its climate goals by 2035.

Carbon to Sea published an independent MRV review of Planetary’s first ocean alkalinity credits, having identified progress, uncertainties, and recommendations for improved transparency, environmental monitoring, and data accessibility.

Absolute Climate released version 2.0 of the Absolute Carbon Standard for public consultation, having clarified certification procedures, updated emissions allocation, and improved uncertainty quantification and reversal risk management.

Oxford Institute for Energy Studies published a new policy paper on carbon removal outlining critical challenges and strategic pathways for scaling durable CDR, urging integration of regulatory frameworks, financing, and sectoral coordination.

The European Marine Board released a report, calling for long-term ocean monitoring, better modelling, clear baselines, open data standards and consistent global governance to ensure transparent reporting and independent verification - what it sees as essential for credible, scalable CDR deployment.

Leaderboard Updates - November 2025

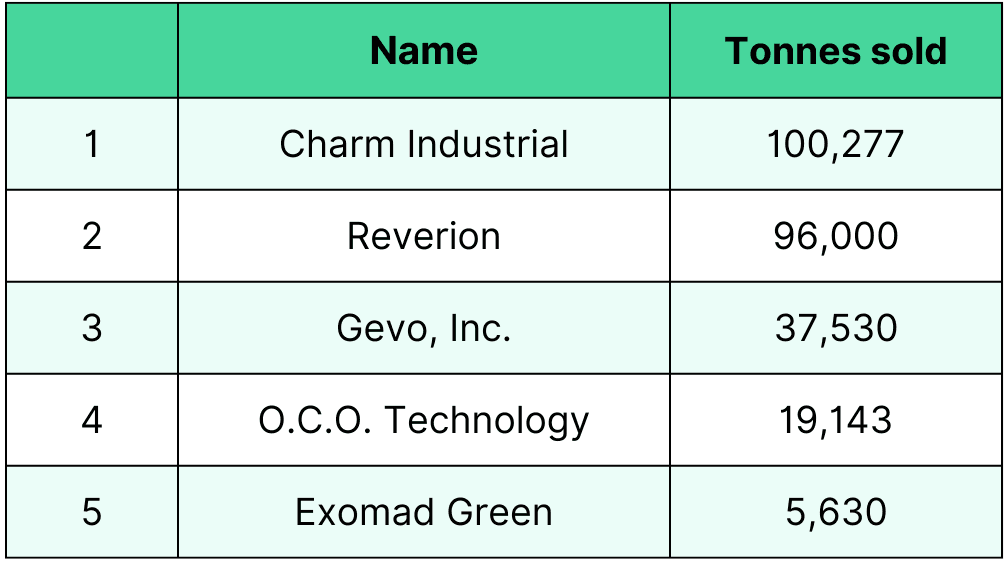

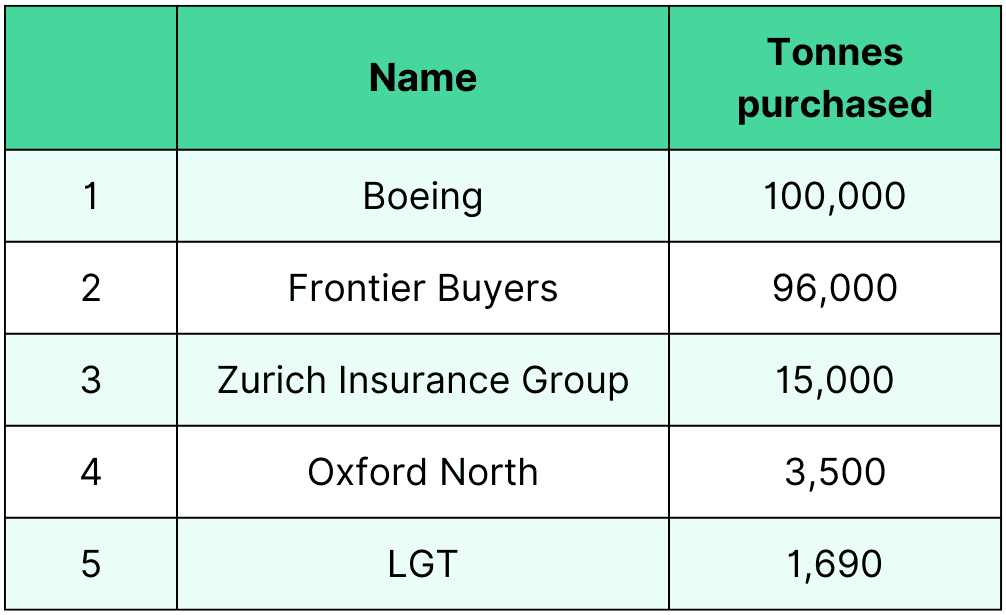

Around 268,000 tonnes of durable CDR were purchased in November, following an October that saw over 490,000 tonnes contracted.

Listed below are the November leaderboards for top suppliers and purchasers:

Supplier Leaderboard

Purchaser Leaderboard

Events Round-up - November 2025

[Image source: OSCAR]

We hosted a webinar in which we launched the Open Standard Carbon Removal Purchase Agreement (OSCAR) — a shared framework designed to simplify and standardize durable carbon removal contracting.

CDR30 hosted several hybrid and virtual events at COP30, from November 10 to 22, 2025 on topics ranging from scaling CDR in the Global South, financing challenges in the sector to the role of parliamentarians in CDR.

CanCO2Re Initiative held a webinar on how CDR does more than just balance CO₂ emissions, as speakers examined broader impacts on the carbon cycle, global temperature, and potential non-carbon risks (e.g., land-use change, fertilizer use) from large-scale CDR deployment.

RMI hosted a webinar exploring the need for carbon removal, critical gaps to scaling the industry, and why a government-led advance market commitment for carbon removal is needed.how suppliers can align with emerging standards to build trust and unlock market access.

Check out the CDR Events Calendar to stay updated with upcoming CDR events!

CDR.fyi Updates and Research

- The Definitive Survey on Carbon Removal Capacity

We recently launched a new survey with The State of Carbon Dioxide Removal team, inviting CDR suppliers globally to complete a short survey about their current and projected capacity.

Supplier participation will directly inform the upcoming State of CDR 2026 report and CDR.fyi’s public data, maps, and insights used across the sector, strengthening the evidence base for global progress and transparency in carbon removal.

For further information, kindly contact us at team@cdr.fyi.

- Introducing OSCAR: The Open Standard Carbon Removal Agreement

We recently published a blog post on the launch of the Open Standard Carbon Removal Purchase Agreement (OSCAR).

Developed collaboratively across the carbon removal ecosystem and shared through CDR.fyi, OSCAR provides a standardised, practical framework to bring clarity and consistency to durable CDR contracting.

OSCAR is available to download along with guidebooks, templates, and definitions to support adoption and implementation.We are also open to any input on what OSCAR‑related webinars you’d be most interested in attending next. Please share your ideas here

For further information, kindly contact us at team@cdr.fyi.

- The State of Durable CDR Financing: Insights from the CDR.fyi x Planet2050 Survey

Today, we released the State of Durable CDR Financing with Planet2050, in which we share insights from a survey of 125 durable CDR suppliers and project developers, offering a clear picture of the financing challenges faced by them.

Please note that the blog post includes only the summary of the comprehensive edition, which is available for free by signing up through the blog post itself.

For further information, kindly contact us at team@cdr.fyi.

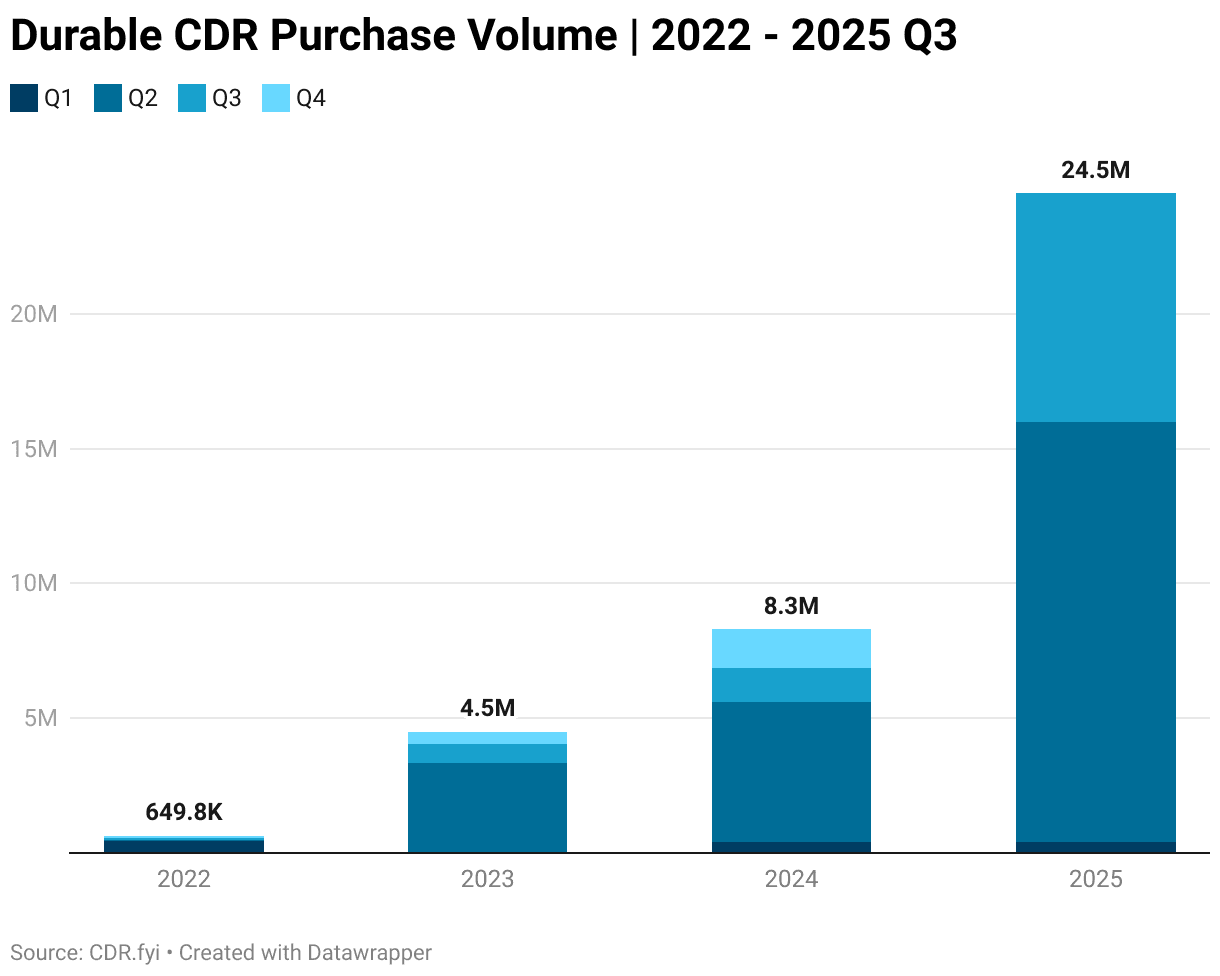

- 2025 Q3 Durable CDR Market Update - Tacking into the Wind

In November, we released the 2025 Q3 Durable CDR Market Update, in which we analyzed and uncovered some key trends from the durable carbon removal market. At

8.5 million tonnes, this was the largest Q3 in durable CDR history, eclipsing the total contracted volume (8M tonnes) in 2024.

Please note that the blog post includes only the summary of the comprehensive edition, which is available for free by signing up through the blogpost itself.

For further information, kindly contact us at partners@cdr.fyi.

- SBTi’s CNZS V2: A Disappointment for CDR and a Threat to the Net Zero Concept

We released an article responding to the Science Based Targets initiative’s second consultation draft of the Corporate Net-Zero Standard (CNZS V2), which introduced some important steps forward, but also raises serious concerns for the future of durable carbon removal.

Read the blog post to learn more.

Stay connected

Follow us on LinkedIn for This Week in CDR and our weekly polls.

We'd love to hear from you! Reach out to us anytime with suggestions or comments at team@cdr.fyi.

Disclosure

CDR.fyi is a public benefit corporation operating globally. The company has numerous contributors, some of whom have affiliations with companies in the industry, including Milkywire, Charm Industrial, CDRJobs, DVNE and ETH. Data and content published by CDR.fyi, including This Week in CDR, this Monthly Update, and our Quarterly Market Updates, are vetted and reviewed by CDR.fyi representatives with no conflict of interest.

Join over 1,000 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!