October 08, 2025

CDR Monthly Recap - September 2025

We are back with another edition of the CDR Monthly Recap, a monthly round-up of some of the top news, developments, and market updates from the world of durable carbon removal.

After a slow August, the durable CDR market in September followed a similar trend with nearly 119,000 tonnes of CDR contracted, led by deals involving Google, Vaulted Deep, Schneider Electric, and Climeworks Solutions.

New projects, partnerships, and large funding opportunities, as well as announcements, continue to drive momentum for the industry ahead, alongside various events in the field.

Read on to learn more below!

Biochar CDR Market Snapshot

Explore insights from the Biochar Carbon Removal Market Snapshot 2025 to understand purchasing trends, delivery vs. retirement dynamics, and what’s shaping biochar’s role in durable carbon removal.

Deals and Partnerships

[Image source: Vaulted Deep]

Deals

Google signed an agreement to purchase 50,000 tonnes from Vaulted Deep, certified by Isometric. Vaulted has also formed a joint initiative with Google and Isometric to explore quantifying the prevention of methane emissions in Vaulted’s waste injection process.

Schneider Electric signed a multi-year agreement with Climeworks Solutions for 31,000 tonnes of durable carbon removal through its portfolio of solutions, including DACCS, BECCS, and Enhanced Weathering.

IMC Trading purchased 4,000 tonnes of CDR from Carboneers, in an offtake agreement facilitated by Cawa. The tonnes will be removed by 2030, and the agreement will support Carboneers’ India-based project producing biochar from agri-waste.

Japanese shipping company NYK signed an agreement to purchase CDR credits from 1PointFive, integrating DAC into its decarbonization strategy to neutralize residual emissions and progress toward its 2050 net-zero goal.

Heba signed a fifteen-year agreement to purchase BECCS credits alongside district heating from Stockholm Exergi as part of its goal to neutralize the climate impact of Heba's new production of properties, with first deliveries in 2029.

Barclays signed an offtake agreement to purchase 6,538 tonnes of CDR from enhanced weathering company UNDO. The agreement was underwritten by CFC, a specialist insurance provider in carbon market initiatives.

Kenya-based DAC company Octavia Carbon signed a 10-year offtake agreement facilitated by Carbonfuture, adding to its list of 20+ corporate partners. The volume and the purchaser were not disclosed.

Sweden’s Biokol was issued Rainbow’s first 1,000-year permanence credits from its forestry-residue biochar, delivering measurable co-benefits such as clean energy, lowering agricultural N₂O emissions, and supporting local producers and rural communities.

Partnerships

Swedish energy company Söderenergi signed an agreement to supply the first CDR credits from its upcoming BECCS plant for pharma company AstraZeneca. The project is expected to remove 500,000 tonnes of CO₂ annually by 2030.

Project developer Planboo and cotton sustainability initiative Better Cotton partnered to integrate biochar into cotton supply chains, aiming to reduce emissions, improve soil health, and generate biochar carbon removal credits.

Brazilian biofuel producer Atvos and biochar producer NetZero partnered to build a biochar factory with an initial capacity to remove 12,500 tonnes of CO₂ annually and field application across Atvos’ supply chain.

AtmosClear selected ExxonMobil to provide services to transport and store 680,000 tonnes of biogenic CO₂ annually from AtmosClear’s Louisiana-based BECCS facility, with potential to expand volumes over time.

Wise extended its partnership with Opna, committing to invest £1 million in high-impact carbon removal projects in climate-vulnerable regions across Latin America and Asia-Pacific. Wise initially invested £500,000 through the partnership with Opna in March.

Isometric partnered with Anglo American to issue Enhanced Weathering credits from Brazil’s Project Earthstone, a partnership between Anglo American and ZeroEx, targeting 15 million tonnes of CDR using mining by-products.

GE Vernova announced that it will deploy its solid-sorbent DAC technology at Deep Sky Alpha in Canada, with operations slated to begin by late 2026 after R&D validation at GE’s advanced research centers.

South Pole announced that it will launch TechGen, a CDR buyers’ club with its founding buyers in 2026, aiming to aggregate corporate demand and finance multi-year offtakes of a diverse portfolio of global CDR projects.

Microsoft and Equinor signed a strategic agreement to advance CO₂ transport, storage, and CO₂ removal credit value chains in Northwestern Europe and the United States, supporting CCS infrastructure for hard-to-abate sectors.

Want to know more about durable CDR?

Join over 1,000 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!

Projects

[Image source: Aircapture]

Aircapture announced the launch of its first commercial Direct Air Capture unit in Fukushima, Japan. Developed in collaboration with AIZAWA Concrete Corporation, it is Japan’s first DAC-to-concrete project.

Carbon Removal Canada launched Carbon Console, an interactive dashboard tracking companies, projects and capacity, providing real-time market intelligence to inform policy, investment, and development decisions in Canada.

Yama announced that it has completed the construction of France’s first DAC pilot, scaling 56X in a year from lab to a 22-tonnes/year module using ~1,250 kWh/tonne in energy via its proprietary electrochemical technology.

CO280 awarded Preliminary Front-End Engineering and Design (Pre-FEED) contracts for a Canadian pulp and paper mill project aiming to capture and permanently store 800,000 tonnes of biogenic CO₂ annually, starting in 2029.

1PointFive announced that its STRATOS Direct Air Capture facility has received an AAApre rating from BeZero Carbon, signaling high confidence in its DAC-based CDR credits and low execution risk ahead of its 2025 launch.

Carbyon unveiled Carbyon GO, a compact, modular DAC unit claimed as the world’s fastest. For 1 kg of sorbent material, it is capable of capturing 3 tonnes of CO₂/year, reaching 90% saturation in 100 seconds.

Mast Reforestation completed the world's largest biomass burial project in Montana in the US, burying fire-killed trees to prevent carbon release. Mast expects to generate up to 5,000 tonnes of CDR credits by 2026 Q1.

Green Carbon partnered with Varhad Capital and Carbonfuture on one of India’s largest biochar carbon removal projects, with the potential to generate ~120,300 tonnes of CDR credits through Carbonfuture.

Pronoe and Instituto Tecnológico de Canarias (ITC) signed an agreement on Project Teydea to demonstrate the industrial integration of its CO2 removal technology at a desalination plant in Gran Canaria, Spain.

Ucaneo announced that it has begun work on a first-of-a-kind, energy-efficient electrochemical DAC demonstration plant in Berlin, with an initial capacity of ~150 tCO₂ per year starting in the second half of 2026.

Equatic, Boeing, and SEDC Energy partnered to develop a CDR demo facility in Sarawak, Malaysia; the demo targets ~365 tonnes of CDR, while producing 10 tonnes of green hydrogen annually.

Origen Carbon commissioned a new kiln at the Energy & Environmental Research Center (EERC), North Dakota, that is equipped with its limestone-based direct air capture technology. The kiln is capable of enabling over 2,000 tonnes of CO₂ removal per year.

Get Custom Reports from CDR.fyi

Get custom reports with data coverage across specific data on durable CDR transactions, insights and analysis from our surveys, and insights on equity investments. Email team@cdr.fyi to get started.

Financing

Image source: Puro.earth

Puro.earth raised €11 million in a Series B round led by Nasdaq, with Fortum Innovation & Venturing. The investment will help Puro scale its supplier infrastructure, enabling more frequent CORC issuance, easier offtakes, and integration of digital MRV.

Deep Sky secured an $11 million credit facility from Finalta Capital, designed to finance its capital investments in carbon capture, storage & utilization (CCUS), marking Canada’s first debt-financed carbon removal infrastructure deal.

Rock Flour Company raised €6.1 million in seed funding led by the Export and Investment Fund of Denmark (EIFO) and Novo Holdings to scale its enhanced weathering technology using glacial rock flour.

Dutch company Brineworks raised €5 million to commercialize its low-cost DAC technology. The investment round was led by SeaX Ventures, with participation from Pale Blue Dot, First Momentum, AiiM Partners, Energie360°, and Katapult.

Palo Alto-based startup DACLab emerged from stealth with a $3 million seed funding round and the launch of Kelvin, its first commercial DAC system, which is designed to commercialize carbon removal for e-fuels and CO₂ sequestration operators.

CDR marketplace CUR8 announced its seed round fundraise, led by Airbus Ventures. The investment round also saw participation from existing investors, GV (Google Ventures) and CapitalT.

Equilibrium secured $3 million in seed funding from Peak XV Partners, Kalaari Capital, and Avaana Capital to scale projects spanning agroforestry, mangroves, regenerative agriculture, and biochar across nine states and 120,000 hectares in India.

Altitude expanded its Ascent 1 CDR purchasing facility from 50,000 to 250,000 tonnes, establishing itself as one of the world’s leading CDR financiers, continuing its commitment to scale biomass-based carbon removal technologies.

Carbon Drawdown Initiative launched Carbon Removal Shops, a new directory that makes it easier for individuals and small/mid-size businesses to find vendors for CDR credits in small volumes.

Pricing Mismatch in Durable CDR

Explore insights from the Durable CDR Pricing Survey, conducted in partnership with OPIS, to help market participants better understand pricing expectations for durable CDR credits.

Policy

[Image source: Robert So]

The state of California passed three bills to accelerate CDR, including recognizing CDR operations as a compliance offsets category, making CDR projects eligible for an $85 million funding program, and establishing a state CDR Purchase Program.

COP30 will host the first-ever carbon removal pavilion, backed by CDR30, a global coalition, spotlighting durable CDR solutions and elevating their role in climate diplomacy and global climate goals.

The World Resources Institute published a roadmap showing how U.S. states can scale DAC through targeted policies, infrastructure investment, and workforce development to meet climate goals and boost local economies.

The Carbon Business Council and its partners released a CDR policy primer for Canada with recommendations to position the country as a global CDR hub, unlock demand, mobilize investment, and capture the emerging market.

Research and Reports

[Image source: NewClimate]

NewClimate published a report assessing 35 companies’ durable CDR efforts, urging separate reduction and removal targets, commit near-term spend, define durability with safeguards, improve disclosure, treating durable CDR as a public good.

ClimeFi and the World Ocean Council published an article showcasing marine CDR deals progress, profiling Equatic–Boeing and Gigablue–SkiesFifty from pilots to commercial offtakes, including MRV, permitting, and risk allocation considerations.

Puro.earth opened public consultation on updates to its Enhanced Rock Weathering methodology, seeking feedback incorporating five key changes to streamline high-quality, field-ready delivery.

BlueLayer and Supercritical published a report outlining key trends and recommendations for improving the Request for Proposal (RFP) process across the carbon removal industry, focusing on solutions for market participants on both sides.

Climate Tech Atlas, a platform showcasing climate solutions like greenhouse gas removal, was recently launched by an interdisciplinary coalition including Breakthrough Energy, McKinsey, and Speed & Scale.

Counteract VC published an article exploring biochar’s economic sweet spot, analyzing cost curves, scalability, and market dynamics to identify where biochar CDR can thrive commercially and environmentally.

Rainbow (formerly Riverse) and Sinkco Labs unveiled the first MRV protocol for accrediting biomass burial beneath anoxic marine sediments, targeting traceable, durable carbon storage.

The OpenAir Collective announced the launch of its 2026 Carbon Removal Challenge, inviting university students worldwide to design innovative solutions for removing CO₂ from land, water, or air.

Heriot-Watt University launched what it calls the first university-led online course on carbon removal, offering academic credit, combining scientific, technical, and economic insight with real-world relevance.

WRI Climate published a new piece, highlighting 6 key things to know about DAC, including the evolving space, various challenges that it faces, and what it means for the future of carbon removal.

Japanese information services company Exroad released a report, supported by CDR.fyi, summarizing the latest trends in the global and domestic CDR market, covering topics ranging from regulation and pricing to certification and corporate procurement strategies.

MaRS Discovery District published a report exploring Canada’s emerging role in CDR, exploring the current funding landscape, the latest startup milestones, as well as scaling challenges and opportunities.

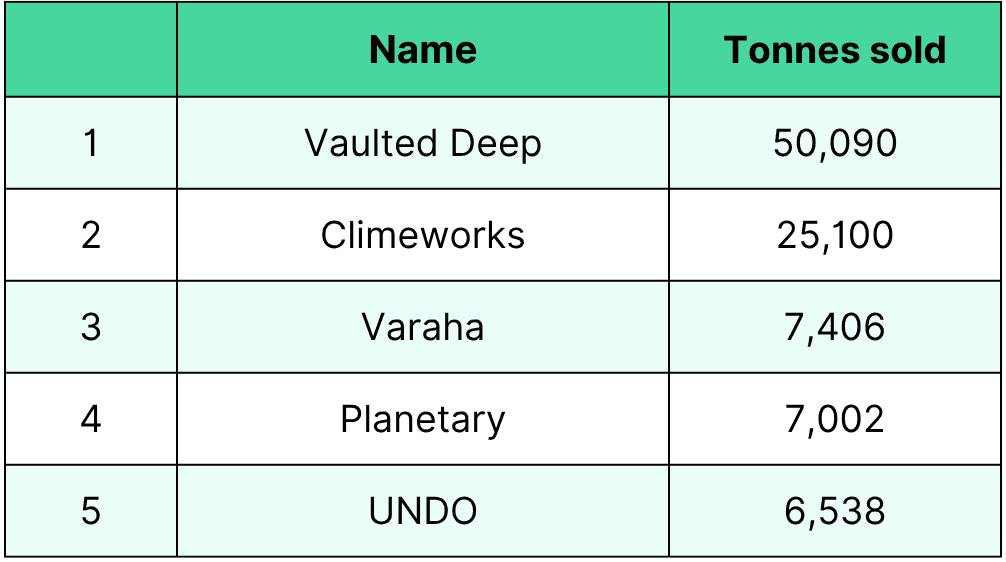

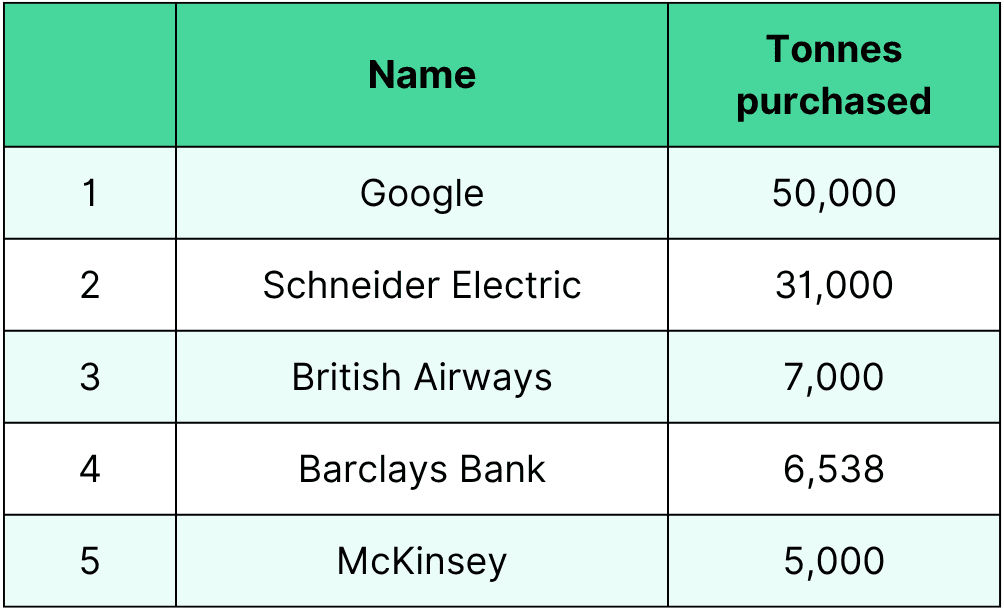

Leaderboard Updates - September 2025

Nearly 119,000 tonnes of durable CDR were purchased in September, following an August that saw around 193,000 tonnes contracted.

Listed below are the September leaderboards for top suppliers and purchasers:

- Supplier Leaderboard

- Purchaser Leaderboard

Events Round-up - September 2025

[Image source: Climate Week New York]

This year’s Climate Week New York brought together industry pioneers, experts, and stakeholders in the carbon removal ecosystem, which included various summits and events by organizations such as Puro.earth, Isometric, Carbon Business Council, Supercritical, Varaha, and Climeworks, amongst others.

Sylvera held a webinar bringing together perspectives from buyers as well as suppliers in the carbon removal market, discussing how to navigate the market amidst various uncertainties.

Carbon Unbound hosted a webinar exploring how CDR30, a global coalition of interdisciplinary experts in the CDR industry, will advocate for scaling CDR across policy, investment, and innovation.

UPTAKE held a webinar on the demand-side dynamics of the CDR market featuring leaders from organizations such as Milkywire, CEEZER, and Carbon Direct.

Check out the CDR Events Calendar to stay updated with upcoming CDR events!

CDR.fyi Updates and Research

- Biochar Carbon Removal Market Snapshot 2025

In September, we released the Biochar Carbon Removal Market Snapshot 2025, in which we analyze the dynamics behind biochar’s rapid rise and explore what sales, deliveries, and buyer behavior reveal about its role in the state of the durable CDR market.

In addition to the blog post, a more extensive report is available to our Data Partners and Platform Subscribers through the CDR.fyi Portal. For access to the full report or further information, kindly contact us at team@cdr.fyi.

Stay connected

Follow us on LinkedIn for This Week in CDR and our weekly polls.

We'd love to hear from you! Reach out to us anytime with suggestions or comments at team@cdr.fyi.

Disclosure

CDR.fyi is a public benefit corporation operating globally. The company has numerous contributors, some of whom have affiliations with companies in the industry, including Milkywire, Charm Industrial, CDRJobs, DVNE and ETH. Data and content published by CDR.fyi, including This Week in CDR, this Monthly Update, and our Quarterly Market Updates, are vetted and reviewed by CDR.fyi representatives with no conflict of interest.

Join over 1,000 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!